The budget is a planning tool to revise what has been done throughout the year and set plans in place for next year. The budget addresses and spans across several industries and departments and affects every citizen.

The objective of the 2023 budget was to address and manage the issue of inflation, which has become a hot topic in the recent months. Measures and subsidies shall be implemented in order to stabilize an uncertain economy.

This article aims to break down and categorize the salient points discussed in this year’s budget.

Economy

The deficit for 2022 is estimated to be 5.8%, an improvement from 2021, and is expected to decrease further in 2023, at 5.5%. GDP growth is projected to be 3.5%.

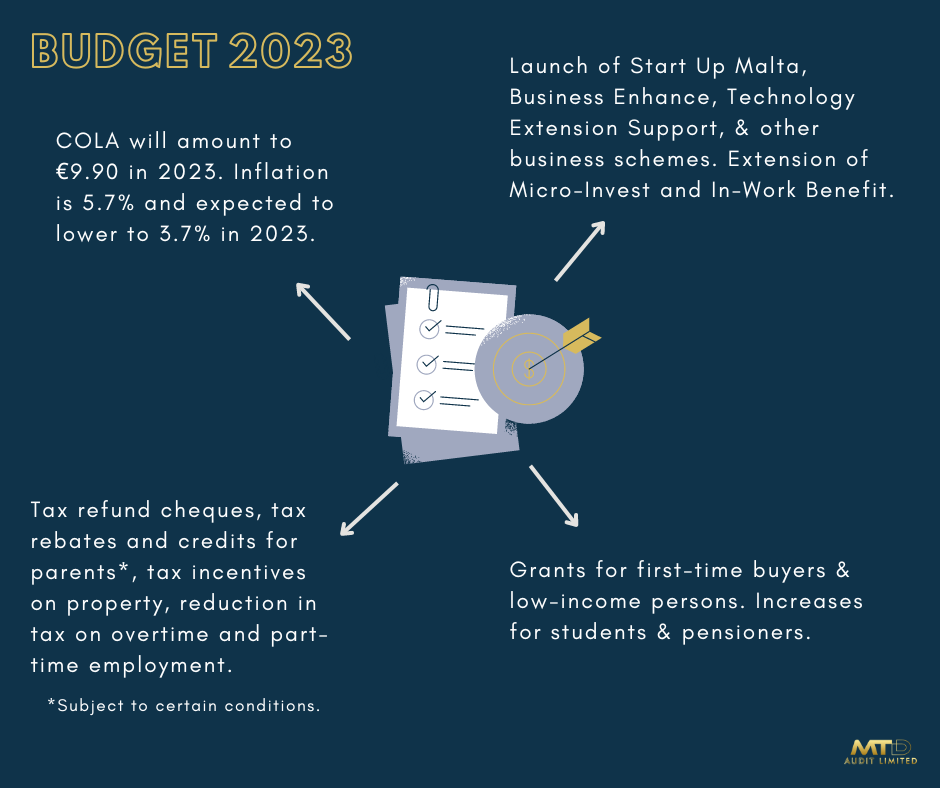

Unemployment is estimated to be 3.1% and inflation stands at 5.7% in 2022. The employment level is expected to rise by 3.4%. Meanwhile, the predictions for 2023 are that unemployment shall stabilize at 3.1% and inflation will decrease to 3.7%. Inflation mitigating measures are estimated to amount to €600m.

COLA for 2023 will amount to €9.90 per week. Pensioners, employees, and those receiving social security benefits will benefit from this increase.

Enterprise

The Micro Invest and In-Work Benefit schemes have been extended. Additionally, new schemes have been introduced, namely Start Up Malta, Business Enhance, and Technology Extension Support.

Start Up Malta is a one-stop-shop aimed at helping start-ups with budding companies and benefit from funding schemes.

Business Enhance is a scheme where €40m shall be available for SMEs and other entities to benefit from in aims of undertaking digitization projects and increasing energy efficiency. Learn more about the grants for Digitalization and Renovation.

A €50,00 rent subsidy is available for local business over a maximum of 6 years. The government also announced the extension of tax incentives on the transfer of family business. Additionally, any unabsorbed capital allowance due the pandemic can be used in 2023.

Taxation

In 2023 there shall not be major changes to the tax system. However, the tax refund cheques shall be reinstated.

Tax credits of €200 and rebates of €300 are available for parents with children with disability and parents who send their children to extracurricular activities. Children’s allowance is to increase by €90 per child.

There will be a reduction on tax rates on income from overtime and from part-time employment. There will be no income tax cuts, rather energy costs will be subsidized.

40% of pensioners’ working income will be exempt from tax. The non-taxable ceiling will reflect the increase, now capped at €14,968. Couples benefitting from two pensions and are registered as married, shall benefit from an exemption of €3,600 income.

Writers shall benefit from a reduced tax rate of 7.5% on royalties pertaining to their book.

Social

First-time buyers shall be entitled to a €10,000 grant over 10 years. However, the cost of the property must not exceed €500,000 and the contractual agreement must be backdated to 1st January 2022.

Stipends shall be increased pro-rata. Around 80,000 low-income people are to receive an additional grant of around €300 before Christmas.

Pensioners are to receive a €12.50 increase, in addition to other benefits. Pensioners will receive a cost-of-living bonus of up to €1.50 per week, and service pensioners will benefit from an additional €200 to their social security exemption. Widowed pensioners will benefit from an increase to match that of their deceased spouse, with the increase being capped at €3.54 per week. Pensioners who do not qualify for contributory pension will receive an extra €50 per year. Retired people with less than 5 years’ contribution will receive €450 per year, and those with 5 to 10 years’ worth in contributions will receive €550.

A new scheme has been introduced to encourage members of the discipline corps to work past their 25-year retirement period. They will benefit from a 23% increase should they work for an additional 4 years.